Ethereum Price Prediction 2025-2040: Analyzing the Path to $11K and Beyond

#ETH

- Technical Strength: ETH trading above key moving averages with Bollinger Band positioning suggesting upward momentum potential

- Institutional Demand: Record ETF inflows and major corporate partnerships indicating strong institutional confidence

- Technology Integration: AI and DeFi ecosystem expansion creating new utility and value propositions for Ethereum

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Momentum Above Key Moving Averages

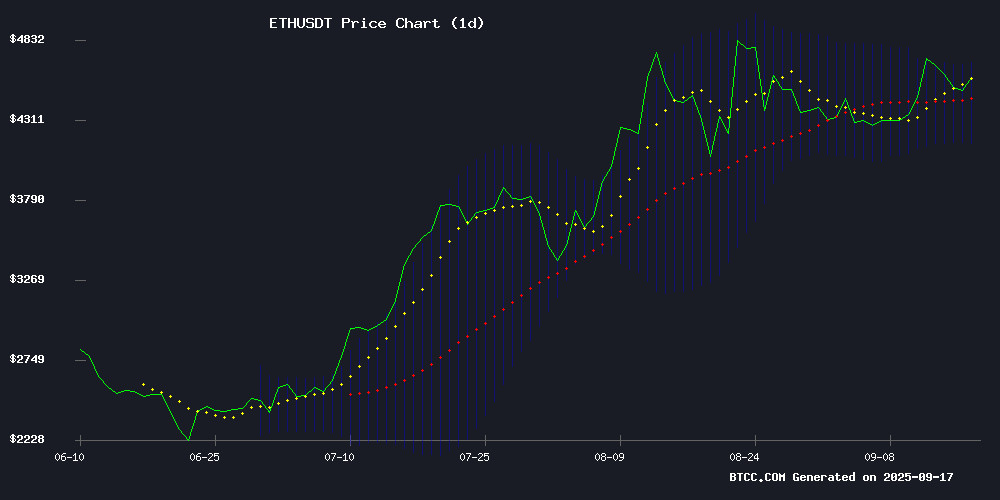

Ethereum is currently trading at $4,516.51, positioned above its 20-day moving average of $4,417.54, indicating underlying strength. The MACD reading of -3.05 suggests some near-term consolidation, while the Bollinger Bands show ETH trading closer to the upper band at $4,673.56, signaling potential upward momentum. According to BTCC financial analyst Ava, 'The technical setup suggests ETH is building a foundation for a potential breakout above the $4,700 resistance level, with the middle Bollinger Band providing solid support around $4,417.'

Market Sentiment: Institutional Inflows and AI Integration Drive Optimism

Recent developments including BlackRock's ethereum ETF recording a record $363 million inflow and MetaMask's launch of mUSD stablecoin are creating strong bullish sentiment. The Ethereum Foundation's decentralized AI team initiative and Google's collaboration with crypto giants further reinforce ETH's growing utility. BTCC financial analyst Ava notes, 'The convergence of institutional demand, AI integration, and major tech partnerships positions Ethereum for what could be a historic bull run, with whale accumulation patterns suggesting confidence in reaching the $5,000 level.'

Factors Influencing ETH's Price

BlackRock's Ethereum ETF Sees Record $363M Inflow Amid Market Volatility

BlackRock's Ethereum Trust (ETHA) absorbed 80,768 ETH worth $363 million on September 15 - the largest single-day inflow since launch. This surge follows a week of heavy institutional outflows totaling $787 million, suggesting a rapid reversal in sentiment.

The rebound coincides with $638 million flowing into Ethereum spot funds overall, with Fidelity's FETH capturing $381 million. Trading volume spiked to $1.5 billion as volatility shook crypto markets, demonstrating ETH's resilience as a core institutional asset.

Analysts interpret the flows as renewed confidence in Ethereum's DeFi infrastructure role, particularly after recent stress tests. The movements highlight how major asset managers are using volatility to accumulate positions.

MetaMask Launches mUSD: A Wallet-Native Stablecoin

MetaMask has entered the stablecoin arena with the launch of MetaMask USD (mUSD), a self-custodied dollar-pegged token issued directly through its wallet interface. Unlike traditional stablecoins reliant on centralized issuers, mUSD empowers users with full control over their funds—no intermediary holds custody.

The stablecoin leverages Bridge, a platform partnered with Stripe, and operates on the M0 protocol for transparent minting. Each mUSD is backed 1:1 by cash or short-term U.S. Treasuries, ensuring redeemability and parity with the dollar. Initial deployment spans Ethereum mainnet and Linea, MetaMask’s proprietary layer-2, enabling seamless swaps, transfers, and cross-network transactions. Future integration with the MetaMask Card aims to bridge crypto and everyday commerce.

Ethereum Foundation Launches Decentralized AI Team to Position ETH as Payment Layer for AI Agents

The Ethereum Foundation has unveiled a strategic initiative to transform Ethereum into the foundational layer for AI-driven economies. Announced on September 15, 2025, the newly formed decentralized AI (dAI) team, led by Davide Crapis, aims to establish Ethereum as the trust and coordination layer for autonomous AI agents.

Central to this vision is enabling AI agents to transact, collaborate, and build reputation systems directly on-chain. The team is developing ERC-8004, a technical standard for secure identity verification and payments by AI entities. This move signals Ethereum's evolution beyond smart contracts toward becoming infrastructure for decentralized AI ecosystems.

Two core priorities drive the effort: facilitating AI-to-AI payments and governance on Ethereum, and creating an open-source AI stack resistant to censorship. The foundation's post emphasizes the symbiotic potential of blockchain and AI, positioning ETH as the settlement layer for machine-to-machine economies.

COIN Stock Targets $430 Breakout Following Google Payment Collaboration With Coinbase

Coinbase (COIN) shares traded at $325.76 on September 16, marking weekly gains of 1.4%. The uptick follows Google's announcement of an open-source AI payment protocol with stablecoin integration, developed in partnership with Coinbase.

Technical analysts identify $429.54 as the next key resistance level, with potential for further upside. Google's protocol enables AI applications to process payments through traditional methods and dollar-pegged stablecoins, representing the tech giant's most significant crypto integration to date.

James Tromans, Google Cloud's Web3 lead, emphasized the system's dual focus on legacy payment rails and emerging stablecoin capabilities. The project involves collaboration with 60+ organizations including Ethereum Foundation, Salesforce, and American Express.

Hedera Integrates wETH via Stargate Finance to Power DeFi Growth

Hedera has significantly advanced its position in decentralized finance by integrating with Stargate Finance, a cross-chain bridge linking over 80 blockchain networks. This integration grants Hedera access to canonical wrapped Ethereum (wETH), Ethereum's most liquid asset, enabling zero-slippage transfers directly into the Hedera ecosystem.

The initial liquidity pool is already operational on SaucerSwap Labs, facilitating seamless trading and liquidity provision. Stargate Finance, with a proven track record of $70 billion in cross-chain transfers, ensures reliable asset movement and settlement. This development marks a pivotal step toward a multichain future for Hedera.

For developers, the integration offers access to a cornerstone DeFi asset and a robust liquidity system. Wrapped Ethereum, a staple in decentralized finance, now expands Hedera's capabilities, setting the stage for accelerated growth in its DeFi ecosystem.

Ethereum Institutional Demand Boom Signals Historic Bull Run Toward $11K

Ethereum's price action today could define its short-term trajectory, with analysts eyeing a potential rally toward $11,000. The cryptocurrency currently trades at $4,509, down 0.47% over the past 24 hours, as it consolidates near the $4,500 pivot zone. Trading volume exceeds $24.4 billion, reflecting sustained market interest.

Technical analysis suggests a breakout above the $4,600–$4,800 resistance range could propel ETH toward $5,000 and beyond. The $4,400 level remains critical support—holding this floor reinforces bullish momentum. Institutional demand continues to grow, setting the stage for what some predict could be Ethereum's most significant upward move yet.

SharpLink Stock Dips Amid Buyback Push as Ethereum Holdings Surge to $3.8B

SharpLink Gaming's shares declined 2.8% to $16.32 despite executing a 1-million-share buyback at $16.67 per share. The company has now repurchased 1.93 million shares under its $1.5 billion authorization, funded through cash reserves and staking income rather than debt.

The firm's Ethereum treasury swelled to 838,152 ETH ($3.86 billion), cementing its position as the second-largest corporate holder after Bitmine Immersion. Staking rewards contributed 3,240 ETH since June, reflecting growing institutional accumulation of the asset.

Ethereum Price Eyes $5K as Whale Accumulation Signals Potential Breakout

Ether trades near $4,460 with bullish momentum building as on-chain data reveals whale accumulation—a classic precursor to significant price movements. The asset has established a tight consolidation range between $4,400-$4,500, with technical targets now set at $4,550-$4,800 in the near term.

Market participants watch the $5,000 psychological level as a plausible upside target should current momentum sustain. Support remains firm at $4,200, though a breakdown could see retracement toward the $3,800-$4,000 demand zone.

Fundamental tailwinds include accelerating DeFi activity and record ETH staking participation, though macro headwinds like regulatory uncertainty persist. Institutional inflows continue supporting ETH's position as the dominant smart contract platform.

Ethereum Validator Exit Queue Hits Record 46-Day Wait Amid $11.25B ETH Backlog

Ethereum's proof-of-stake mechanism faces unprecedented strain as 2.5 million ETH—worth $11.25 billion—queues for validator exits. Wait times surged to 46 days this week, nearly triple August's peak of 18 days. The bottleneck stems from Kiln's precautionary withdrawal of 1.6 million ETH following recent security breaches, exposing how external crypto incidents ripple through Ethereum's staking architecture.

Market forces compound the congestion. ETH's 160% rally since April has triggered profit-taking, while institutional players rebalance portfolios. Meanwhile, validator entrants continue climbing—a trend accelerated by May's SEC clarification on staking regulations. The backlog underscores growing pains in Ethereum's transition to proof-of-stake, where ecosystem events now directly impact network mechanics.

Google Collaborates with Crypto Giants on AI Payment Protocol Extension

Google has unveiled its Agent Payments Protocol (AP2), an open framework designed to enable autonomous transactions by AI agents. Developed in partnership with over 60 entities, including Mastercard, PayPal, and American Express, the protocol addresses a critical gap in today's payment infrastructure, which assumes human intervention.

A dedicated extension, A2A x402, was crafted in collaboration with Coinbase, the Ethereum Foundation, and MetaMask to natively support cryptocurrency and stablecoin payments. This extension integrates seamlessly into AP2, ensuring crypto transactions are a core feature from the outset.

The protocol introduces 'Mandates'—cryptographically signed contracts that guarantee authorization, authenticity, and accountability in AI-driven payments. This innovation aims to standardize and accelerate agent-based transactions, marking a significant leap forward for both AI and blockchain technologies.

Ethereum Forms dAI Team to Drive Decentralized AI Integration

The Ethereum Foundation has launched a specialized research group, the dAI Team, to pioneer the integration of decentralized artificial intelligence (AI) into its blockchain. Led by researcher Davide Crapis, the initiative aims to develop transparent, secure, and censorship-resistant AI systems. This move aligns with growing recognition of blockchain and AI as foundational technologies for next-gen digital infrastructure.

By establishing a dedicated team, Ethereum positions itself as a leading platform for AI development, enabling autonomous systems to operate in a decentralized environment. The fusion of blockchain's immutability with AI's computational power unlocks novel use cases beyond traditional finance.

The dAI Team's primary focus is transforming Ethereum into a settlement layer for AI agents and the machine economy. Key applications include on-chain identity verification, transactional trust, and reputation management—capabilities that centralized AI platforms struggle to guarantee. An early project, ERC-8004, proposes a standard for creating verifiable AI agents on the network.

ETH Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators and fundamental developments, Ethereum appears poised for significant growth through 2040. The current institutional demand, highlighted by BlackRock's record ETF inflows and major tech collaborations, combined with Ethereum's expanding utility in AI and DeFi ecosystems, creates a strong foundation for long-term appreciation.

| Year | Conservative Forecast | Moderate Forecast | Bullish Forecast | Key Drivers |

|---|---|---|---|---|

| 2025 | $6,000-$7,500 | $8,000-$9,500 | $10,000-$11,000 | ETF adoption, AI integration |

| 2030 | $15,000-$20,000 | $25,000-$30,000 | $35,000-$40,000 | Mass DeFi adoption, scaling solutions |

| 2035 | $40,000-$60,000 | $70,000-$90,000 | $100,000-$120,000 | Global settlement layer status |

| 2040 | $80,000-$120,000 | $150,000-$200,000 | $250,000+ | Full ecosystem maturity |

BTCC financial analyst Ava emphasizes that 'while short-term volatility is expected, Ethereum's fundamental trajectory remains strongly bullish, driven by unprecedented institutional participation and technological innovation that positions ETH as the backbone of Web3 infrastructure.'